IRMAA

An Insurance for Business Article

Business ownership can be a pivotal strategy in planning for retirement, particularly when it comes to managing Medicare's Income-Related Monthly Adjustment Amount (IRMAA) surcharges.

For business owners, structuring retirement income to avoid these surcharges is both an art and a science.

This article examines how business ownership can serve as a strategic avenue to create retirement income streams that minimize vulnerability to IRMAA calculations.

Q: Why would a business owner buy long term care insurance,

when the business could buy it for them?

Yours, with our thanks for answering 2 quick LTC questions.

Actually . . . IRMAA is the secret

Understanding IRMAA

IRMAA is the premium adjustment for higher-income Medicare beneficiaries. It uses modified adjusted gross income (MAGI) from two years prior to determine surcharges.

These surcharges are an additional cost added to Medicare Part B and Part D premiums for beneficiaries with income above certain thresholds.

The MAGI includes gross income plus tax-exempt interest and other specific sources. The eligibility thresholds are adjusted annually.

Income Sources That Avoid IRMAA Surcharges

The

key to avoiding IRMAA surcharges lies in understanding which income streams do

not count as part of your MAGI.

Roth IRA Distributions: Tax-free qualified withdrawals from Roth IRAs are not

included in MAGI. Business owners can contribute to Roth IRAs during the

business's operating years and then strategically use distributions during

retirement.

Health Savings Accounts (HSAs): Distributions for qualified medical expenses

are not taxable and thus not included in MAGI.

Life Insurance Loans: Taking loans against life insurance policies do not

count as income for IRMAA purposes.

Non-taxable Social Security: Depending on filing status and other income,

some portion of Social Security may remain non-taxable and thus not part of the

MAGI.

Leveraging Business Ownership

Retirement

Accounts Through Business: Business owners can create 401(k)s or SEP IRAs,

offering higher contribution limits than individual retirement plans.

Income Timing and Manipulation: Business owners can control the timing of

income realization; for instance, delaying invoicing or restructuring sales

terms to influence year-end financials.

Valuation and Sales Strategies: Sale of the business can be structured to

receive payments over time, spreading out income to minimize spikes that

increase MAGI.

Potential Strategies for Structuring Retirement Income

Diversified

Income Streams: Utilize multiple income streams such as dividends, and reverse mortgages as alternative funding sources that might not

affect MAGI.

Investing in Long-term Capital Gains: Consider the impact of long-term

capital gains, which are taxed differently and might provide flexibility in

managing MAGI.

Trusts and Estate Planning: Establish irrevocable trusts during business

operations as a method to pass wealth without impacting MAGI.

Hierarchy of Strategies

Short-term

strategies: Roth conversions before reaching eligibility for Medicare,

establishing a clear timeline for contributing to Roth IRAs and HSAs.

Medium-term strategies: Developing exit plans like staggered business sales

and structuring retirement accounts to convert traditional IRAs to Roth IRAs

progressively.

Long-term strategies: Setting up trusts, securing long-term investments, and

planning business valuation strategies.

Step-by-Step Guidance for Business Owners

1. Project Your Retirement Income Needs: Estimate your retirement expenses to determine the necessary income level.

2. Analyze Your Current Business Structure: Evaluate your business's legal structure (sole proprietorship, LLC, S-corp, C-corp) and its impact on your tax liability.

3. Maximize Business Deductions: Ensure you're taking all legitimate business deductions to minimize your taxable income. Consult with a tax professional to identify potential deductions.

4. Optimize Retirement Contributions: Contribute the maximum amount allowed to your business's retirement plan (SEP IRA, SIMPLE IRA, 401(k)).

5. Develop a Roth Conversion Strategy: Consider converting portions of your traditional IRA to a Roth IRA during years with lower income, ideally before retirement. Consult a financial advisor to determine the optimal conversion amount and timing.

6. Explore HSA Contributions: If eligible, maximize your HSA contributions to build a tax-advantaged medical expense fund for retirement.

7. Consider Tax-Efficient Investments: Invest in tax-efficient vehicles like municipal bonds to minimize taxable income.

8. Plan for Business Succession or Sale: Develop a long-term plan for your business, including succession planning or a potential sale. Structure the sale to minimize tax implications.

9. Monitor Your MAGI: Regularly track your MAGI to anticipate potential IRMAA surcharges and adjust your income strategy accordingly.

10. Consult with Professionals: Work with a RICP, financial advisor, and tax professional to develop a personalized retirement income plan that minimizes IRMAA and maximizes your retirement security.

Reducing your IRMAA

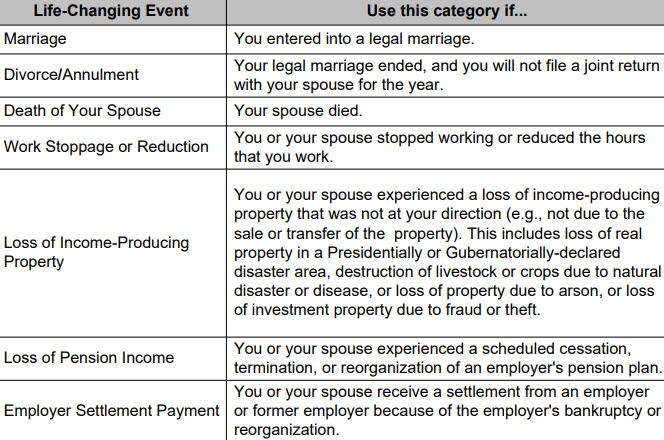

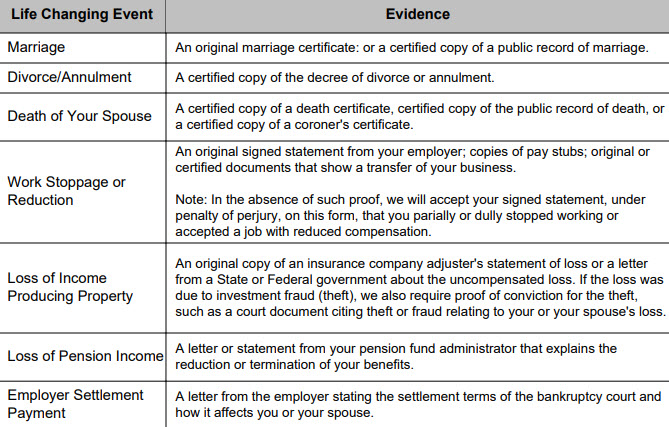

If you had a major life-changing event, such as:

and your income has gone down, and you can document the life changing events:

you may use this form to request a reduction in your income-related monthly adjustment amount.

See page 5 of the form for detailed information and line-by-line instructions.

If you prefer to schedule an interview with your local Social Security office, call 1-800-772-1213 (TTY 1-800-325-0778).

Conclusion

Business owners have unique opportunities to structure their income in ways that can alleviate potential IRMAA surcharges during retirement.

By utilizing Roth accounts, managing when and how they receive business sales proceeds, and implementing strategic financial planning, entrepreneurs can effectively manage their retirement income streams.

This foresight not only protects their wealth, but also mitigates unwanted expenses, allowing for a more financially stable retirement phase.

Sources

Centers for Medicare & Medicaid Services. "Medicare Part B Costs." CMS.gov, www.medicare.gov/your-medicare-costs/part-b-costs. Accessed 25 Oct. 2023.

Internal Revenue Service. "Publication 560, Retirement Plans for Small Business." IRS.gov, www.irs.gov/publications/p560. Accessed 25 Oct. 2023.

The Video at the beginning of this article

is the first episode in a series.